What is the US Dollar Index?

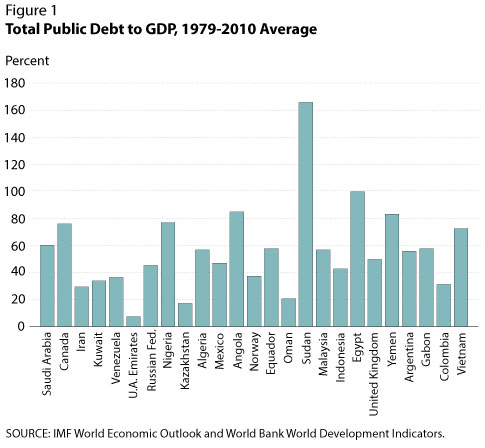

It also is the parent company of the well-known New York Stock Exchange. The New Highs/Lows widget provides a snapshot of US stocks that have made or matched a new high or low price for a specific time period. Stocks must have traded for the specified time period in order to be considered as a new High or Low. Since then, the US Dollar Index has tracked economic performance and liquidity flows. For example, it rose as the current account generated a surplus in the 1990s, fell as US debt levels increased in the 2000s, and rallied as investors flocked to the relative safety of the Dollar during the Great Recession. Commodity prices tend to fall (at least nominally) as the Dollar increases in value – and vice versa.

This can be due to changing inflation figures, trade, as well as a multitude of political factors. The 10Yr Yield is falling sharply during early Europe trading, while the DXY is surging higher — there’s a massive divergence between Yield abd US Dollar — and looks like equities are voting to go with the falling DXY. ICE, specifically, ICE Futures U.S., monitors the index methodology to ensure that it properly reflects the covered currencies and the FX market in general and makes adjustments as and when necessary (which is like…never). The Index was adjusted once when the euro was introduced as the common currency for the European Union (EU) bloc of countries.

Gold futures settle at a 3-week high as U.S. economic data pressure the dollar and Treasury yields

In the coming years, it is likely currencies will be replaced as the index strives to represent major U.S. trading partners. It is likely in the future that currencies such as the Chinese yuan (CNY) and Mexican peso (MXN) will supplant other currencies in the index due to China and Mexico being major trading partners with the U.S. https://1investing.in/ The contents of the basket of currencies have only been changed once since the index started when the euro replaced many European currencies previously in the index in 1999, such as Germany’s predecessor currency, the Deutschemark. Dollar Index in 1985, ICE compiles, maintains, determines, and weights the components of the U.S.

- The importance of the US dollar in global trade created the demand for an index that tracked the performance of the dollar against other important currencies.

- I don’t see Wednesday’s Federal Reserve announcement changing that fact.

- The dollar on Wednesday garnered support from the stronger-than-expected U.S.

Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward intensive growth strategy trend or a buy. Here we can see that USD is the base currency in four of the six currency pairs included, with these given a positive value for the purposes of the calculation. The Euro and Pound are the base currency for the two others, with these given a negative value. Western Texas Intermediate (WTI), the US crude oil benchmark, is trading around the $88.40 mark so far on Wednesday.

Rates

The dollar index can be traded just like an equity index and is especially convenient for traders that cannot monitor the individual pairs that make up the index. The DXY often increases on days where there is dollar-positive news and decreases on days where there is dollar-negative news. As an example, The DXY will rise whenever the USD is mentioned on television, in a positive light. In the same way, the DXY will lower in value when dollar-negative news – such as war casualties – are at the forefront of the media.

The USDX is based on a basket of six currencies with different weightings (see above). The index calculation is simply the weighted average of the U.S. dollar exchange rates against these currencies, normalized by an indexing factor (which is ~50.1435). The US Dollar (USD) attracts some dip-buying following the previous day’s good two-way price swings and holds steady above mid-104.00s through the Asian session on Wednesday. The USD Index (DXY), which tracks the Greenback against a basket of currencies, however, remains confined in the weekly trading band as traders keenly await the US consumer inflation figures before placing fresh directional bets.

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. You agree to the company’s Terms and Conditions and the Privacy Notice by using this site.

Historical Prices

The Federal Reserve created an official index (DXY) in 1973 to keep track of the dollar’s value. The dollar changes constantly in reaction to shifts in the ongoing forex trades. Before the creation of the dollar index, the dollar was fixed at $35 per ounce of gold, and it had been that way since the 1944 Bretton Woods Agreement. The U.S. dollar index is a measurement of the dollar’s value relative to six foreign currencies as measured by their exchange rates.

US Dollar Index Has Been Growing for Five Consecutive Weeks … – Kitco NEWS

US Dollar Index Has Been Growing for Five Consecutive Weeks ….

Posted: Tue, 22 Aug 2023 07:00:00 GMT [source]

She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest. Similarly, if the index is currently 80, falling 20 from its initial value, that implies that it has depreciated 20%. The appreciation and depreciation results are a factor of the time period in question. The U.S. Dollar Index has risen and fallen sharply throughout its history. Over the last several years, the U.S. dollar index has been relatively rangebound between 90 and 110. This website is using a security service to protect itself from online attacks.

Major Stock Indexes

Before the Euro, the index also included five other European currencies. The US Dollar Index was started by the Federal Reserve in 1973 and has been managed by ICE Futures US since 1985. It compares the value of the US Dollar against six currencies used by major US trade partners – the Euro (EUR), Japanese Yen (JPY), Pound Sterling (GBP), Canadian Dollar (CAD), Swedish Krona (SEK) and Swiss Franc (CHF).

- The US Dollar index rises when the USD rises relative to a basket of the above-mentioned currencies and vice versa.

- The ICE U.S. Dollar Index is calculated in real-time approximately every 15 seconds.

- The Index was adjusted once when the euro was introduced as the common currency for the European Union (EU) bloc of countries.

The ICE Exchange symbol for the value of the underlying Dollar Index (sometimes called the cash or spot index) is also DX (without a month or year code), although different data providers may use different symbols. This makes the USDX a pretty good tool for measuring the U.S. dollar’s global strength. The below chart shows some of the major events that affected the USDX price since 2005. Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator.

Real Time News

In this article, you’ll be introduced to the US Dollar index, which shows dynamic patterns of the American currency and helps to find additional signals for Forex trading. Stay in the know with the latest market news and expert insights delivered straight to your inbox. The US dollar has consolidated after the latest economic report suggested the Fed’s work may be coming to an end.The US dollar has consolidated after the latest economic report suggested the Fed’s work may be coming to an end.

The U.S. dollar index allows traders to monitor the value of the USD compared to a basket of select currencies in a single transaction. It also allows them to hedge their bets against any risks with respect to the dollar. It is possible to incorporate futures or options strategies on the USDX. A trading strategy comprises a set of rules that defines the necessary parameters for traders and investors to trade in financial markets.

Therefore, when you trade DXY using CFDs, you speculate on the direction of the underlying asset’s prices without actually owning it. After the gold standard was abandoned, countries switched to floating currency rates. The importance of the US dollar in global trade created the demand for an index that tracked the performance of the dollar against other important currencies. The U.S. Dollar Index can be traded as a futures contract for 21 hours a day on the ICE platform. The U.S. Dollar Index futures contract derives its liquidity directly from the spot currency market, estimated to have a turnover of over $2 trillion daily.

It’s very similar to how the stock indices work in that it provides a general indication of the value of a basket of securities. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods.

Federal Reserve in 1973 after the dissolution of the Bretton Woods Agreement. It is now maintained by ICE Data Indices, a subsidiary of the Intercontinental Exchange (ICE). A monetary policy designed to stimulate an economy drives currency values, as for example, a country reducing interest rates or increasing money supply also reduces the attractiveness of its currency for foreign investors. The value of the US Dollar Index fell in 2020 after the initial flight to safety, as the US Federal Reserve policy to reduce interest rates to record lows and stimulate investment reduced the value of the dollar. In addition to futures and options contracts, one of the easiest and most popular ways to trade the DXY is with contracts for difference, or CFDs. A CFD is a type of contract, typically between a broker and a trader, where one party agrees to pay the other the difference in the value of an asset, between the opening and closing of the trade.

US Dollar (DXY) Undecided After Chair Powell’s Speech Gives Little Away – DailyFX

US Dollar (DXY) Undecided After Chair Powell’s Speech Gives Little Away.

Posted: Fri, 25 Aug 2023 07:00:00 GMT [source]

The index climbed from the record low of 70.70 in March 2008 prior to the crisis to 88.58 by February 2009. It fell back to the 74 level by 2011, but has since moved higher. The DXY Dollar Index was created by the US Federal Reserve in 1973, after the Bretton Woods system of payments based on the dollar came to an end. Countries decided to let their currencies float freely rather than being pegged at fixed rates to the US dollar, after the US government suspended the gold standard. The system established rules for trading between the US, Canada, Western Europe, Australia and Japan after the Second World War. The equity funds tracking the dollar index are ETFs, which means they can be traded on the stock exchange just like any other stock.